| Administrator Guide > Loan Origination Overview > Defining Models |

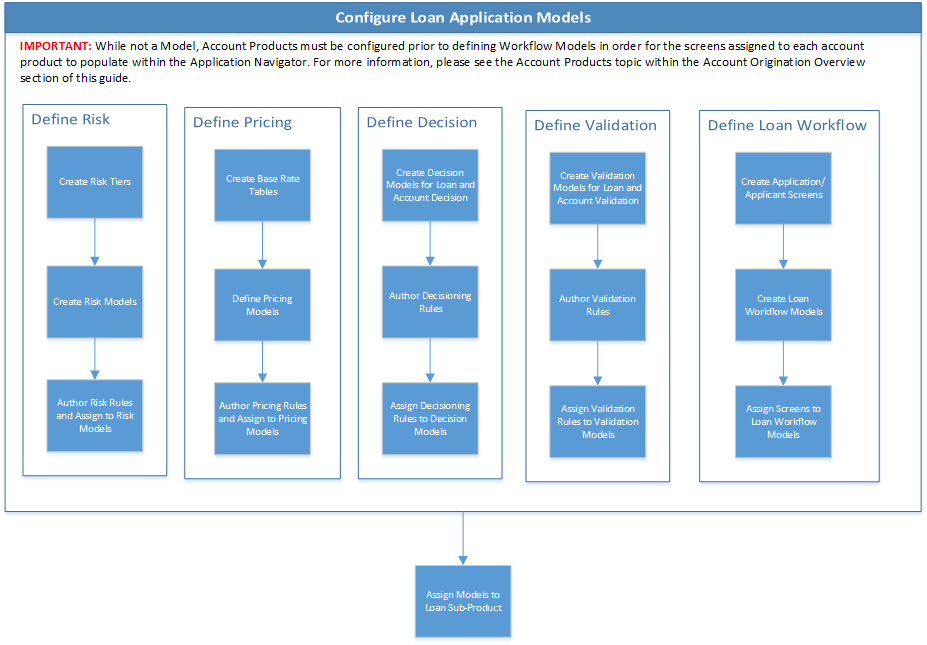

Models allow institutions to apply institutional lending and new account policies. Models are assigned to each sub-product, in order to allow institutions to automate and standardize application processing.

| Model | Description | ||

| Risk |

Risk Models use business rules and matrices based on institutional lending policies and tolerances to assign applicant risk and determine creditworthiness.

|

||

| Pricing |

Pricing Models use base rate totals, thresholds, and rules to determine application interest rates.

|

||

| Decision |

Decision Models use business rules and matrices based on institutional lending policies and tolerances to automatically render loan application decisions.

|

||

| Workflow |

Workflow Models provide institutions the ability to increase the efficiency of the application process by ensuring only relevant screens appear within the workspace. In addition to assigning screens to the workspace, workflow models enable administrators to create a roadmap for completing applications using screens.

|

||

| Validation |

Validation Models use business rules to ensure data within a loan application matches an expected value prior to rendering a decision, generating documents, and issuing disbursement for a loan application. Upon execution, the Validation rules assigned to the Validation Model in this drop-down automatically evaluate the data entered within an application and can be configured to issue an error, warning, or information message to prevent or continue the application process, as well as create a to-do for Disbursement, Post-Disbursement, and/or Post-Decline action items.

|

||

| Account Decision |

Account Decision Models use business rules and matrices based on institutional new account policies and tolerances to automatically determine if an applicant meets criteria to attain an account at the financial institution.

|

||

| Account Validation |

Account Validation Models use business rules to ensure data within a non-member loan application matches an expected value prior to rendering a decision, generating documents, and issuing disbursement for a new account. Upon execution, the Validation rules assigned to the Account Validation Model automatically evaluate the data entered within an application and can be configured to issue an error, warning, or information message to prevent or continue the application process, as well as create a to-do for Disbursement, Post-Disbursement, and/or Post-Decline action items.

|

Once the aforementioned models are defined, they are assigned at the sub-product level.

For more information on assigning models, see the Sub-Product topic.